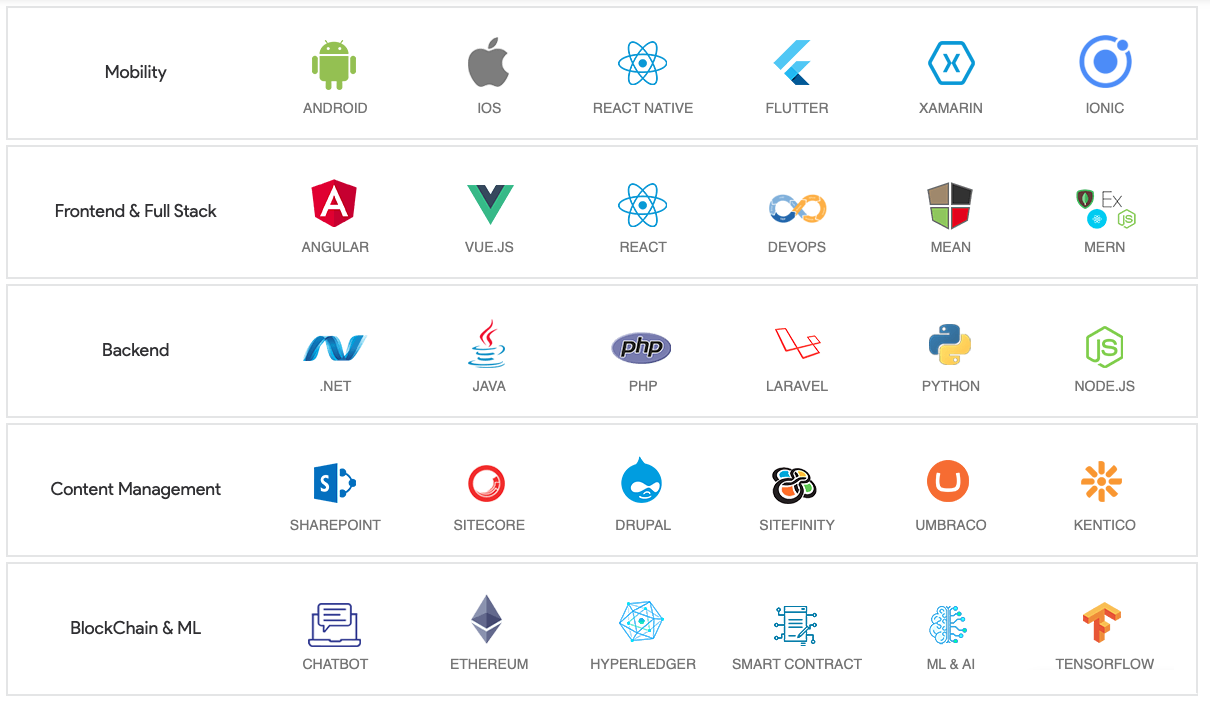

From small business owners to individuals, we help them to eliminate all technology roadblocks by modernizing technology furthermore delivering the best solutions to empower them to grow.

Business depends on firm IT system from your web presence to digital performance. We handle all aspects of your IT foundation being a one-stop for your all technical problems. We have a team of professional IT experts providing quality services.